How do you keep your finger on the pulse of gold prices?

It’s a question I hear all the time.

Knowing the gold price is crucial for making informed decisions in today’s unpredictable market.

With platforms like Fintechzoom, tracking these prices has always been challenging.

So, let’s examine what you need to know about gold prices and how to leverage Fintechzoom in your investment strategy.

Why Gold Prices Matter

Gold isn’t just shiny stuff you wear around your neck.

It’s an asset that has been trusted for centuries.

Here’s why keeping an eye on gold prices is essential:

- Safe Haven: When the stock market dips, gold often rises. Investors flock to it during uncertainty.

- Inflation Hedge: Gold has a historical reputation for holding its value when inflation hits.

- Portfolio Diversification: Including gold in your investment portfolio can lower overall risk.

Knowing the current gold price is like checking the weather before heading out. You wouldn’t leave the house without knowing if it would rain, right?

What Drives Gold Prices?

Understanding what affects gold prices is critical to making intelligent moves.

Here are some significant factors:

- Market Demand: Prices go up when people want gold for jewelry or investments.

- Economic Conditions: Gold prices usually rise as a safe investment option if the economy is shaky.

- Interest Rates: Lower interest rates make gold more attractive because it costs less to hold.

- Geopolitical Events: Wars or political instability can cause spikes in gold prices as people seek stability.

The Role of Fintechzoom

So, how does Fintechzoom fit into this picture?

It’s your trusty sidekick for tracking gold prices.

Real-Time Updates

One of the best features of Fintechzoom is that you get real-time updates on gold prices.

Imagine being able to check prices at a moment’s notice.

- Set Alerts: You can set alerts to notify you when prices hit your desired levels.

- Historical Data: Check out past prices to spot trends.

User-Friendly Design

Navigating Fintechzoom is like walking through your local park.

It’s simple.

- Mobile Access: You can access gold prices anytime at home or on the go.

- Comparison Tools: Easily compare current prices to historical data.

How to Use Gold Price Data

How do you use this information now that you have access to it?

Let’s break it down.

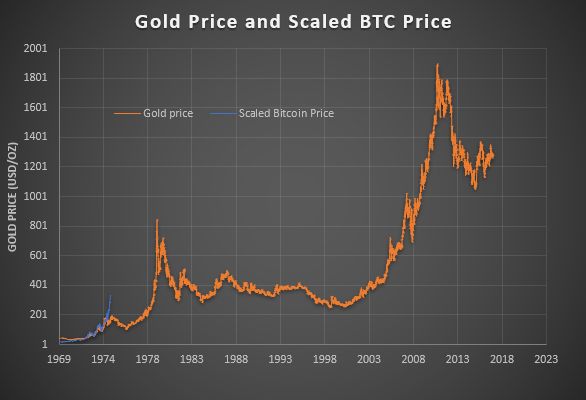

Look at Historical Trends

Digging into historical trends is crucial for spotting patterns.

- Graphs and Charts: Use them to visualize how prices have changed.

- Seasonal Trends: Notice any patterns that emerge during certain times of the year.

Stay Updated on Global Events

Keep an eye on global news.

Here’s what to watch for:

- Economic Reports: Pay attention to unemployment rates and inflation reports.

- Political Events: Wars or elections can affect gold prices.

FAQs About Gold Prices

What’s the best way to track gold prices?

Using platforms like Fintechzoom gives you real-time updates and alerts for price changes.

Why do gold prices fluctuate?

Prices fluctuate due to market demand, economic conditions, and geopolitical events.

Should I invest in gold right now?

This depends on your financial situation. Research thoroughly or consult a financial advisor.

How do interest rates affect gold prices?

Gold becomes more attractive when interest rates are low, often leading to higher prices.

Can I invest in gold through ETFs?

Yes, exchange-traded funds (ETFs) are a popular way to invest in gold without physically owning it.

Understanding the Australian Gold Market

If you’re in Australia, gold has a unique significance.

Australia is one of the world’s top gold producers.

Understanding local dynamics can give you an edge.

Local Market Influences

Several factors can influence gold prices in Australia:

- Mining Industry: The performance of major companies like Newcrest Mining can affect supply.

- Regulatory Changes: New regulations can impact mining operations and supply.

Currency Impact

The Australian dollar’s performance against the US dollar plays a vital role.

- Weak Dollar: A weaker Aussie dollar makes gold more expensive, often driving up demand.

- Strong Dollar: A strong dollar can make gold cheaper, affecting demand.

Investing in Gold: Strategies

If you’re thinking about investing in gold, you have several options.

Let’s explore the most popular strategies.

Physical Gold

Buying physical gold is straightforward but comes with its own set of challenges.

- Gold Bullion: Consider purchasing gold bars or coins.

- Storage Costs: You’ll need a secure way to store your gold, which can be expensive.

Gold ETFs

Exchange-traded funds (ETFs) are an excellent way to invest in gold without the hassle of storage.

- Diversification: Gold ETFs can include a mix of gold-related assets.

- Liquidity: They can be bought or sold quickly on stock exchanges.

Mining Stocks

Investing in mining stocks gives you indirect exposure to gold prices.

- Performance Factors: Mining stocks are influenced by factors beyond gold prices, like management and operational efficiency.

- Higher Risk: While they can offer higher returns, they come with increased risk compared to physical gold.

Gold Futures

Trading gold futures is for the more experienced investor.

- Leverage: Futures allow you to control large amounts of gold with less capital.

- Risk Management: Understand the risks involved, as futures can lead to significant losses.

Making Informed Decisions

Staying informed is your best strategy.

Here’s how to ensure you make sound decisions.

Regularly Update Your Knowledge

Keep yourself updated on the latest trends.

- News Sources: Follow reputable financial news outlets for updates.

- Expert Analysis: Look for analyses from financial experts who specialize in precious metals.

Engage with the Community

Connecting with fellow investors can offer fresh insights.

- Online Forums: Join discussions about gold investing.

- Social Media Groups: Follow investment groups to gain new perspectives.

Conclusion: Your Path to Gold Investment Success

Staying updated on the gold price through Fintechzoom is critical to making informed investment decisions.

With the correct information and tools, you can navigate the complexities of gold investing confidently.

Whether you’re considering Bruny Island accommodation for your next holiday or looking to build your investment portfolio, knowledge is your best ally.

So keep those gold prices on your radar, and make your moves wisely!

Additional Resources

- Gold Market Trends: Regularly check for trends affecting the gold market.

- Investment Strategies: Learn about various strategies to maximize your returns.

- Financial Planning: Consider consulting a financial advisor for tailored advice.